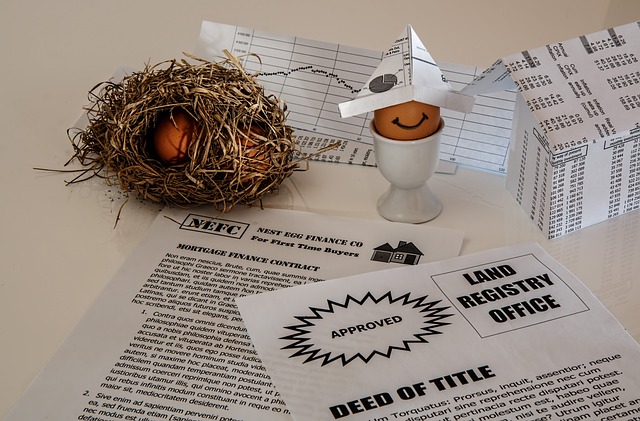

Legal aspects of international real estate transactions: a checklist for investors

International real estate transactions require a clear legal checklist covering title verification, valuation, acquisition terms, financing structures, tax planning and operational governance. Investors should review jurisdictional restrictions, dispute resolution options and reporting obligations to protect capital, preserve liquidity and manage portfolio risk across borders.

Cross-border property investment combines market opportunity with legal complexity. Before committing funds, investors must secure clear title, confirm permitted uses under local planning regimes and identify any encumbrances that could limit future disposal or development. Early legal review aligns acquisition expectations with financing and tax planning, helping to reduce downstream disputes that can erode equity and impair portfolio performance.

Property valuation and legal verification

A robust valuation depends on legal certainty as much as market comparables. Legal checks should confirm that title records match the physical asset, that easements and covenants are identified and that planning permissions support intended use. Engage local valuers and legal advisers to reconcile market valuation with any latent defects, environmental liabilities or contingent obligations. Accurate valuation supports negotiation during acquisition and informs realistic assumptions for financing and expected rental income.

Acquisition due diligence and risk assessment

Due diligence should examine the chain of ownership, outstanding charges, current leases and any pending litigation. Contracts for acquisition must include clear conditions precedent, completion mechanics and remedies for breach. Assess political, regulatory and currency risk that could affect transfer of ownership or repatriation of returns. Including enforceable warranties, escrow arrangements and title insurance where available helps allocate risk and offers practical protection against post-acquisition claims.

Financing, mortgage arrangements and capital structure

Cross-border transactions often combine mortgage finance with investor capital and equity partners. Ensure security interests are perfected under local law and inter-creditor priorities are documented when multiple lenders participate. Draft shareholder or joint venture agreements to set capital calls, profit distribution, dilution protections and exit processes. Plan for currency exposure and local banking restrictions that may limit cross-border guarantees or affect refinancing options during holding and development phases.

Equity strategies, portfolio management and diversification

Structuring equity and portfolio governance supports long-term resilience. Use corporate structures and shareholder agreements to define decision rights, allocation of capital and procedures for asset sales. Diversification across jurisdictions and asset types reduces concentration risk but increases legal complexity; coordinate compliance, reporting and dispute resolution across entities. Regularly review portfolio valuation, tenant mix and development pipelines to preserve liquidity and maintain the expected return profile of property holdings.

Rental contracts, tenant risk and liquidity planning

Standardised rental agreements tailored to local landlord tenant law provide predictability in cash flows. Include clear payment security mechanisms, deposit rules and remedies for default, and set transparent rent review procedures. Model vacancy scenarios, capex needs and refinancing windows to maintain sufficient liquidity. Legal clarity on repatriation of rental proceeds and exit mechanics supports operational flexibility and helps manage short term funding pressures across jurisdictions.

Tax, development controls and regulatory compliance

Taxation influences net returns from rental and capital events. Analyse transfer taxes, VAT or equivalent charges on development, withholding taxes on cross-border payments and reliefs under double taxation treaties. Development activity brings additional permitting, construction contract and insurance obligations. Use special purpose vehicles to isolate development risk and document contractor obligations, performance bonds and change control procedures to manage cost overruns and regulatory delays.

A concise legal checklist for international real estate should cover title and valuation verification, comprehensive acquisition due diligence, considered financing and mortgage arrangements, equity and portfolio governance, rental and liquidity planning, and tax and development compliance. Early engagement of experienced local legal and tax advisers and clear contractual allocation of responsibilities reduce uncertainty and support more predictable outcomes for investors operating across borders.